Smart, a London-based startup that helps employers and their employees manage and monitor their pensions, said it has secured $95 million in Series E funding. It plans to use the capital to expand its international footprint and make acquisitions, it said.

Aquiline Capital Partners, a new financier, led the investment, which also included previous investors Barclays, Chrysalis Investments, Fidelity International Strategic Ventures, DWS and Natixis Investment Managers. The value is not disclosed, however sky newswhich leaked the news last night noted that it had “only a modest discount” on its past fundraising — signifying a slight downturn.

For some context on what the figure might be, PitchBook estimates that Smart was valued at $564 million (or £451 million at the current exchange rate). In addition, it was reported back in January 2023 that Smart was trying to raise £100 million ($123 million), significantly more than the $95 million it is announcing today, five months later.

Smart declined to comment on these details; she didn’t dispute it either.

Contents

Down pressure

Tech valuations have experienced a lot of downward pressure over the past year, even in cases where companies showed growth. Smart said group revenue in 2022 was £67m, up 65% from 2021. It also claims to have £5.5bn of Assets Under Management (AUM) on its platform and is on track to have that grow to £10 million by the end of June 2023.

“This investment is a strong acknowledgment of Smart’s success and journey to date, and highlights the tremendous opportunity that lies ahead. It is also a resounding vote of confidence in the UK fintech sector and its leadership in financial services,” said co-founders Andrew Evans and Will Wynne in a joint statement. “We are on a mission to transform retirement, savings and financial well-being… This is a $62 trillion global industry that is in the early stages of disruption, and we are uniquely positioned to take advantage of it. We have already achieved scale and profitability in the UK, with Smart Pension now serving over a million savers, and this support will enable us to achieve that scale and profitability in our global markets across the group. We welcome Aquiline to our board and we are incredibly excited for the years to come.”

Founded in London in 2014, Smart emerged in the wake of the British government automatic registration pension legislation from two years ago, which required employers to offer a workplace pension plan as standard rather than requiring employees to participate. The purpose of this was to get more people to save for retirement through a private pension, but since people can change jobs every few years, it has become somewhat impractical to keep track of their myriad different pension funds that can be dispersed. are across different providers — it can be an administrative minefield.

And that’s essentially what Smart helps with, as the infrastructure for digital pension management.

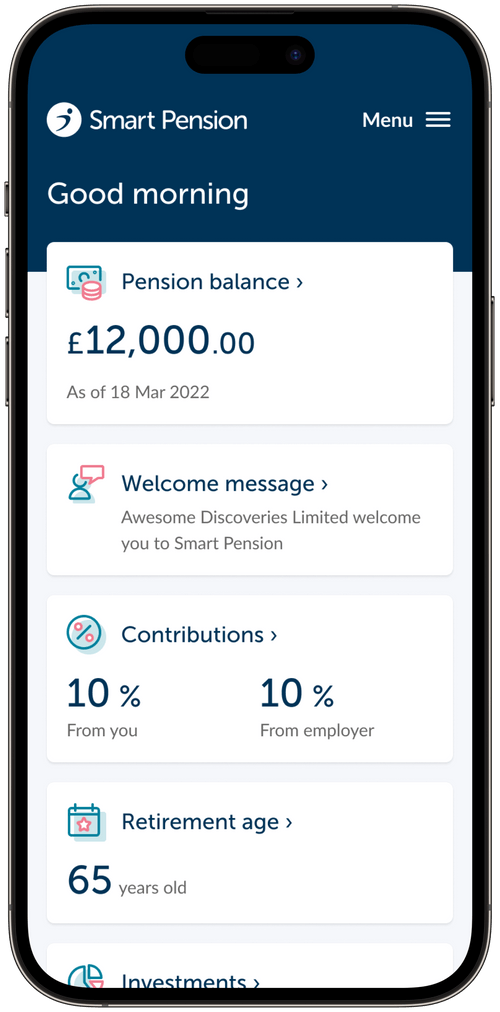

On the one hand, Smart helps employers meet their auto-enrollment obligations by setting up their retirement plans, effectively running its own “master trustwhich it says currently serves 70,000 employers and more than 1 million individuals. On the other hand, Smart also enables savers to consolidate and keep track of their various pensions, so that they are always aware of the current status of their pension pot. Smart does this through a retirement savings technology platform it built called Keystone.

- Smart Retirement App Image credits: Smart

The company also weighs in on how the government has been looking for new guidelines and rules to improve transparency and clarity for policyholders of pension plans.

Go global

While the trillion dollars The UK pensions market is big enough on its own, the company claims extensive to mainland Europe, The United Statesthe Middle East and Asia, funded by at least $230 million in outside investment over the past seven years, although the company also undisclosed Series C round in 2020, what including a minority interest from Barclays.

With another $95 million in the bank, Smart says it plans to expand into other international markets and make some strategic acquisitions. , investors are betting it rides out the storm.

“Smart’s distinctive leadership in retirement technology combined with Aquiline’s deep experience in the retirement technology industry makes this an attractive investment, as does the growing global need for better technology for retirement savings,” said Jeff Greenberg, chairman and CEO of Aquiline. , in a statement. “Smart has consistently delivered impressive commercial growth and is backed by a range of top investors with whom we look forward to joining. Under the leadership of Andrew and Will, we are confident that Smart is a multi-billion dollar company in the making.”

Smart has made acquisitions for inorganic growth in the past, with previous deals including Ensign Master Trust in October 2022 and Stadion Money Management, which focuses on retirement solutions, in January 2022.

Janice has been with businesskinda for 5 years, writing copy for client websites, blog posts, EDMs and other mediums to engage readers and encourage action. By collaborating with clients, our SEO manager and the wider businesskinda team, Janice seeks to understand an audience before creating memorable, persuasive copy.