Wingtra‘s drones are used to conduct surveying missions by organizations around the world, including NASA and the Army Corps of Engineers. Now, the startup is charting a new expansion strategy after securing $22 million in Series B funding, which it will use to improve its current technology and add new features. “Our product roadmap is highly confidential, but let’s just say our high-level vision for a decade or so is to get people out of the loop and have fully automated data collection, processing, and analysis,” co-founder and CEO Maximillion Boosfeld told businesskinda.com.

Based in Zurich, Switzerland, with offices in Fort Lauderdale and Zagreb and nearly 200 employees, Wingtra says it is the world’s largest manufacturer of commercial vertical takeoff and landing (VTOL) drones. It makes mapping drones, develops software for fully autonomous flights and the WingtraPilot app, which collects and processes data from aerial surveys. Wingtra drones are used by surveyors in a wide variety of industries, including construction, mining, environmental monitoring, agriculture, urban planning and land management.

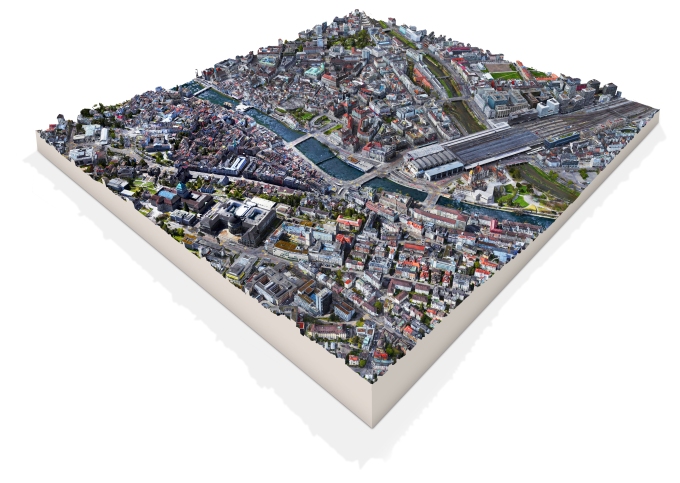

From the images collected with the WingtraOne drone

Investors in Wingtra’s Series B in air mobility fund DiamondStream Partners, EquityPitcher Ventures, Verve Ventures, Ace & Company, the European Innovation Council Fund (EIC Fund), Ace & Company and Spring Mountain Capital founder John L. Steffens.

The genesis of Wingtra came together in 2014 when Boosfeld, Basil Weibel, Elias Kleimann and Sebastian Verling began working on a thesis while studying at ETH Zurich’s Autonomous Systems Lab. The paper proposed a design for a small unmanned aerial vehicle that could take off and land vertically like a helicopter, but transition to a fixed-wing mode for long-haul flight.

While still working on their dissertations, the four registered Wingtra as a company to develop and commercialize the technology. They were accepted into the Wyss Zurich accelerator program, an incubator for commercializing scientific breakthroughs from ETH Zurich and the University of Zurich. During their time in the program, the Wingtra One, a professional mapping and surveying UAV, was developed.

Wingtra’s flagship drone is now the WingtraOne VTOL commercial drone, which is said to be used by hundreds of companies and organizations in 96 countries, including NASA, Texas A&M University, The Ohio State University, CEMEX, Rio Tinto, Army Corps of Engineers and Kenya Red Cross. In total, WingtraOnes makes more than 100,000 flights per year and has mapped 18 million hectares of land and sea.

The startup’s second-generation drone, released in 2021, is called the WingtraOne Gen II and creates research-quality 2D and 3D maps using RGB cameras. Wingtra says a single flight of more than 100 acres can be digitized at 0.5 inch/px, or up to 30 times faster and 90% cheaper than surveying.

The three main industries that Wingtra sells to are construction and industrial, urban and land development, and mining.

Boosfeld told businesskinda.com that the biggest challenge in managing such large assets is the availability of current, accurate and affordable data. Lack of data leads to inefficiencies, high costs and avoidable CO2 emissions. But earth surveys are labor intensive and can be dangerous, as in the case of large construction sites, and it is impossible to risk lives and fines in natural disasters such as landslides.

Wingtra donations are intended to be operational in all those circumstances and make asset management at scale more efficient and sustainable. The startup says they can collect survey-quality data up to 30 times faster than other surveying methods, including other drones or terrestrial tools, and require minimal training to operate due to the WingtraPilot app’s simple control system and automated route planning.

An example of an organization using Wingtra drones to make research data collection more efficient is the Alabama Department of Transportation (ALDOT), which uses them to oversee the maintenance of the state’s road infrastructure. The ALDOT flies drones over construction projects every working day of the week and uses the data collected to ensure, for example, that erosion control measures, including silt fences, are installed correctly.

Another example of how Wingtra is being used is the Red Cross in Kenya, which has deployed the startup’s drones and software managing a major locust invasion. Data collected using Wingtra was able to track locust swarm migration and crop damage, ultimately making decisions on how to mitigate the invasion.

In terms of competition, Wingtra’s best-known rivals are AgEagle’s eBee and DJI’s Phantom 4 RTK and M300. Boosfeld says eBee is the first drone that paved the way for accessible industry-level drone photogrammetry. Both are leading the survey and mapping fields for different reasons: eBee X is a well-industrialized and reliable fixed-wing drone for surveys and mapping, while WingtraOne offers a VTOL combination with high-quality image quality for coverage. But their main differentiation is their takeoff and landing technology, Boosfield said.

WingtraOne’s VTOL allows it to take off and land like a multicopter, before transitioning to a fixed wing to cover large areas. On the other hand, the eBee X is a traditional fixed-wing drone that must be hand-launched and landed on its belly, which Boosfield said means operators must ensure launches and landings take place with a large clearance and in terrain that dry and soft enough to support it. He added that high-end aerial cameras are heavy and fixed-wing drones such as eBee X cannot support their weight. “Currently, only VTOL drones can provide 42MP image resolution, which translates into better accuracy and ultimately more reliable map reconstruction,” he said.

As for the Phantom 4 RTK, Boosfield said that while it’s marketed as a mapping and mapping drone, it doesn’t have much in common with the WingtraOne. Unlike WingtraOne, the Phantom 4 RTK is a typical multirotor, meaning it behaves like a helicopter in the air. This difference means that the WingtraOne is capable of the much wider coverage required for most mapping projects, while multirotors such as Phantom 4 RTK cover relatively limited areas.

DJI’s M300 is a large multirotor that Boosfield says is a good drone for inspection, search and rescue and other mid-range applications, but is less efficient than dedicated mapping systems. For example, even though it’s bigger than the Phantom 4, it’s still a multirotor that relies solely on big batteries to lift it.

Wingtra is also unrelated to the political issues that DJI is doing in the US market, where it has been blacklisted by the US Department of Defense for alleged ties to the Chinese military.

In a statement on the investment, Dean Donovan of DiamondStream Partners said: “We are very excited about partnering with Wingtra. The product’s simplicity of use, highly reliable engineering, and the company’s global network of resellers and service providers have positioned it to extend its leadership in the more than $83 billion map segment of the global air intelligence market. We look forward to helping the company in the United States and Latin America, which will become increasingly important geographies as Wingtra continues to expand.”

Janice has been with businesskinda for 5 years, writing copy for client websites, blog posts, EDMs and other mediums to engage readers and encourage action. By collaborating with clients, our SEO manager and the wider businesskinda team, Janice seeks to understand an audience before creating memorable, persuasive copy.