A robot taxi drove me home a few nights ago, and it was fine.

As it carried me through Golden Gate Park at a steady 27 mph (slowing down to 6 mph for each speed bump), I felt like a packet of information being delivered over a network.

Since our last survey of robotics investors in February 2020, Figure emerged from stealth with his bipedal humanoid robot, and Boston Dynamics’ Atlas became a parkour expert.

Autonomous tractors, semi-trucks and warehouse replenishment bots have gone from concept to reality. Is robotics now mainstream?

Full businesskinda.com+ articles are available to members only

Use discount code TCPLUSROUNDUP to save 20% on a one or two year subscription

“The time in between has been arguably the most important years for the industry,” writes hardware editor Brian Heater, who surveyed 13 investors on a variety of topics including robotics as a service, emerging consumer products and the role it could play. in tackling climate change:

- Milo Werner, General Partner, The Engine

- Abe Murray, Managing Partner, Alley Robotics Ventures

- Kelly Chen, partner, DCVC

- Neel Mehta, venture investor, G2 Ventures

- Oliver Keown, Managing Director, Intuitive Ventures

- Rohit Sharma, Partner, True Ventures

- Helen Greiner, Advisor, Cybernetix Ventures

- Kira Noodleman, Partner, Bee Ventures

- Dayna Grayson, co-founder and managing partner, Construct Capital

- Paul Willard, partner, Grep

- Cyril Ebersweiler, Managing Partner, SOSV

- Claire Delaunay, private investor

- Peter Barrett, co-founder and general partner, Playground Global

Thank you so much for reading TC+ this week!

Walter Thompson

Editorial Manager, businesskinda.com+

@your protagonist

Contents

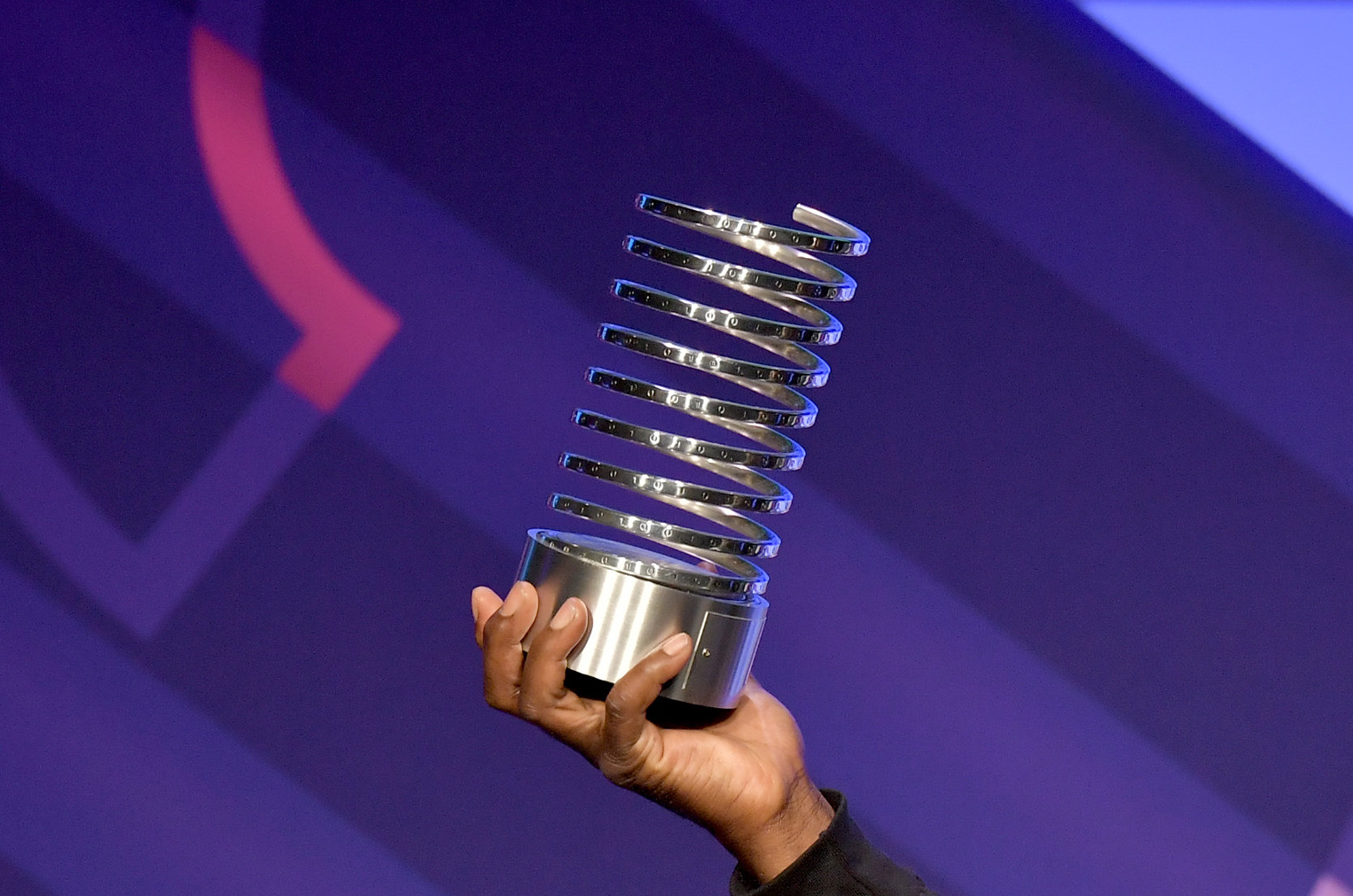

- 1 Vote for businesskinda.com at the Webby Awards!

- 2 4 SaaS engagement metrics that attract investors

- 3 Ask Sophie: How many employment green cards are available each year?

- 4 Secondary market trackers illuminate a traditionally dark deal environment

- 5 VCs still think work software is a wise investment

- 6 MassMutual launches $100 million fund to invest in diverse founders

- 7 Pitch Deck Teardown: Diamond Standard’s $30 Million Series A Deck

- 8 CeFi and DeFi in light of regulation

Vote for businesskinda.com at the Webby Awards!

Image Credits: Michael Loccisano (Opens in a new window) / Getty Images (Image has been modified)

Two businesskinda.com podcasts, Chain Reaction and Found, have each been nominated for Webby Awards in the Best Technology Podcast category.

Cast your vote before Thursday April 20!

4 SaaS engagement metrics that attract investors

Image Credits: Tetra magicians (Opens in a new window) /Getty Images

Past performance doesn’t always predict future results, but it’s the best place to find customer retention metrics that appeal to investors.

According to Oleksandr Yaroshenko, head of investment and strategy at edtech startup Headway, engagement rates for existing customers are “the best predictors of re-enrollment.”

In this post, he explores gamification strategy and shares ideas for building a “golden cohort” that represents your target audience.

Ask Sophie: How many employment green cards are available each year?

Image Credits: Bryce Durbin/businesskinda.com

Dear Sophie,

I’m trying to figure out how long to wait for a green card.

I have two questions for you: how many employment green cards in each category are available each year? How do I understand the Visa Bulletin?

– Standby in San Jose

Secondary market trackers illuminate a traditionally dark deal environment

Image Credits: Getty Images

Startup valuations are down, but by how much?

Instead of waiting for founders to launch their next round of fundraising, savvy players are looking to the secondary markets, “where investors can buy and sell existing stakes in a startup or fund,” reports Rebecca Szkutak.

“These deals have traditionally been harder to track than primary venture capital deals because they are generally not announced, but a new fleet of startups is shedding light on them,” such as Caplight, Notice, Birel and Hive Markets.

“I was so appalled at how fragmented and broken the data was, even as a broker operating every day,” said Tyson Hendricksen, founder of Notice. “It was really hard to figure out what was going on.”

VCs still think work software is a wise investment

Image Credits: NicoElNino/Getty Images

As employers and employees come to grips with the new realities of remote and hybrid offices, investors continue to fund startups producing work software, according to a Deloitte report released this week.

Kyle Wiggers says several trends are fueling venture capital interest in the future of work: In a declining market, investors look for sustainable growth,[s] among more sustainable, rock-solid business-to-business contracts for software tool suites.”

MassMutual launches $100 million fund to invest in diverse founders

Image Credits: We are / Getty Images

Two years after launching the first $50 million MM Catalyst Fund to support diverse founders, insurance company MassMutual is doubling down.

Dominic-Madori Davis interviewed Liz Roberts, the company’s head of impact investing, to learn more about their new $100 million impact fund and discuss how past cash has been allocated.

“We would like to have more colleagues alongside us who invest with these types of theses and insights,” said Roberts. “We are very small in a big opportunity.”

Pitch Deck Teardown: Diamond Standard’s $30 Million Series A Deck

Image Credits: Diamond standard (Opens in a new window)

Diamond Standard secured a $30 million Series A for its blockchain-based investment platform last year and shared its 11-slide deck with businesskinda.com+:

- Cover and mission slide

- Summary slide

- Solution Slide (“Introducing the Smart Raw Material”)

- Problem Slide (“Diamonds Are Severely Underutilized”)

- Market Opportunity (marked as slide 4 on deck)

- Roadmap slide (“How do we make a diamond raw material”, marked as slide 5 on the deck)

- Product Slide 1 (“Diamond Standard Exchange”)

- Product Slide 2 (“Diamond Standard Recycling”)

- ESG slide (“Diamonds are a powerful ESG investment”)

- Founder dia

- Organization slide

CeFi and DeFi in light of regulation

Classen Rafael/EyeEm via Getty Images

Will the FTX debacle lead to a regulatory crackdown on crypto?

“Most expect the worst,” said Ira Lam, chief legal officer at SuperLayer. “A reactive general crackdown on all aspects of crypto, framed as necessary to protect the public from future bad actors, appears imminent.”

In this detailed market analysis, Lam examines the differences between decentralized and centralized financial systems in view of the different ways risk manifests itself in each environment.

“While it may be a long time before we see significant movement towards consumer protection in crypto, one thing is certain: CeFi and DeFi cannot exist without each other.”

Janice has been with businesskinda for 5 years, writing copy for client websites, blog posts, EDMs and other mediums to engage readers and encourage action. By collaborating with clients, our SEO manager and the wider businesskinda team, Janice seeks to understand an audience before creating memorable, persuasive copy.