Frequent readers know I love using equations, so I won’t disappoint:

SaaS companies are like leaky rowboats. If retention rates aren’t strong enough to overcome churn, they will absorb water until they sink to the bottom.

Sid Jain, a senior analyst at ChartMogul, surveyed 2,100 companies and found that “more than half of SaaS companies had lower retention rates in 2022 compared to 2021.”

Full businesskinda.com+ articles are available to members only

Use discount code TCPLUSROUNDUP to save 20% on a one or two year subscription

In this detailed breakdown, he compares net revenue retention rates by ARR range and identifies benchmarks for companies that have yet to fit the product market.

“What’s considered a good net retention rate varies by stage of your business,” advises Jain. “When benchmarking, always take into account the phase your company is in.”

Thanks for reading TC+!

Walter Thompson

Editorial Manager, businesskinda.com+

@your protagonist

Contents

3 ways to amp up your short video and TikTok growth strategy

Image Credits: SOPA images (Opens in a new window) /Getty Images

With over a billion active monthly users, brands of all sizes use TikTok to drive engagement.

But simply being present on the platform is not enough, writes growth expert Jonathan Martinez. To give readers ideas for sharpening short video strategy, he wrote a guide that “distilled it into three simple steps:”

- Competition analysis

- Think about substantive pillars

- Hire creative talent

You don’t raise money to increase your runway

Image Credits: Siriporn Kaenseeya / EyeEm (Opens in a new window) /Getty Images

Raising money for an early-stage startup based on your expected burnout is shortsighted, and unlikely to inspire investor confidence, says Haje Jan Kamps.

“Having clear KPIs that show progress toward the metrics you believe (and, more importantly, your board and prospective investors believe) will unlock your next round of funding,” he writes.

Investors prefer debt over equity (but not venture capital)

Image Credits: Toshirō Shimada (Opens in a new window) /Getty Images

According to Jeremy Abelson and Jacob Sonnenberg of Irving Investors, sharp declines in both VC activity and risk debt are the two main factors limiting fundraising and exit opportunities today.

“Waiting for a recovery in public market multiples to maintain previous valuations has not proven to be a good strategy, and now an ever-increasing group of companies are vying for a shrinking pool of VC and crossover capital,” they write.

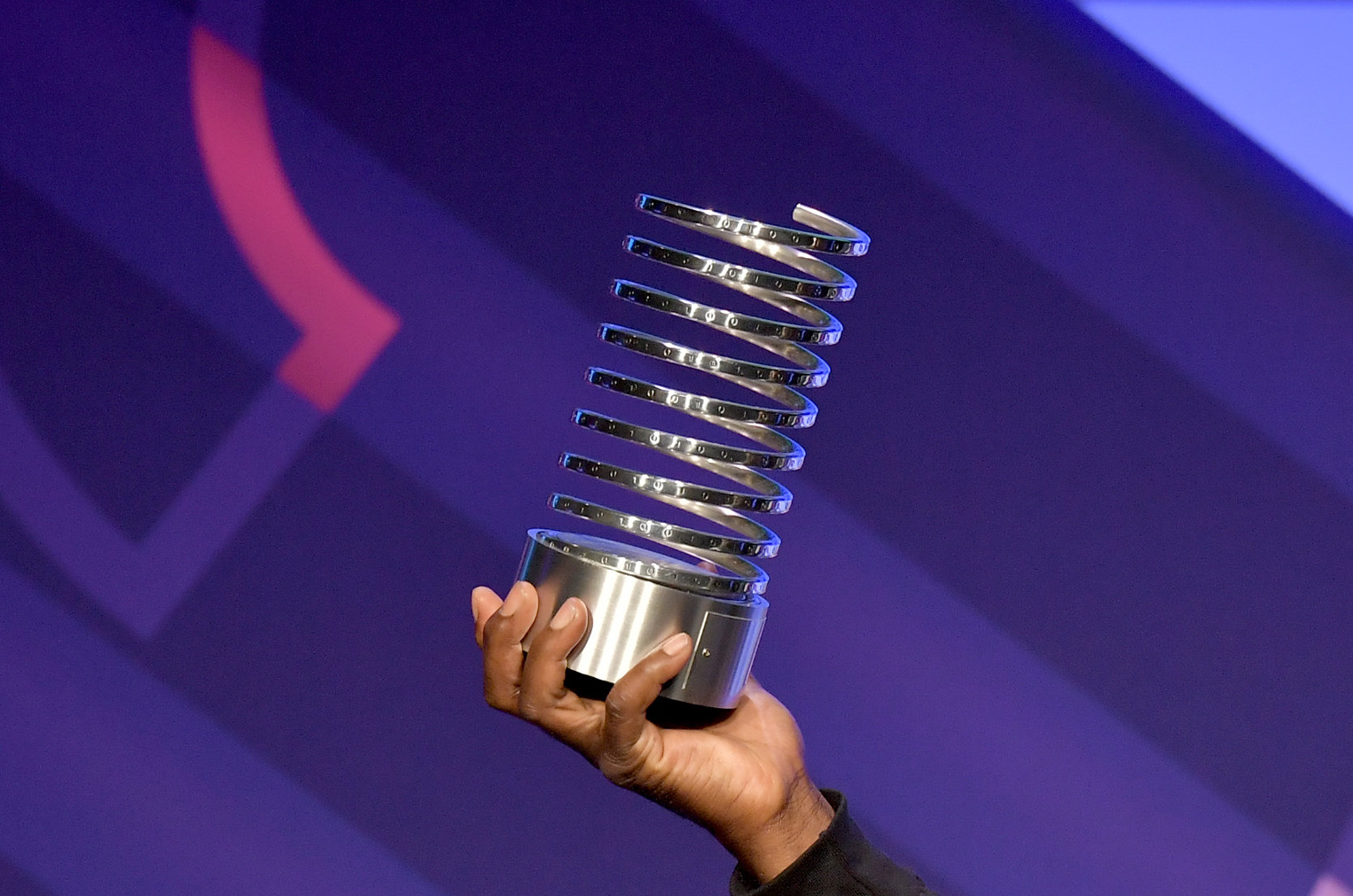

Vote for businesskinda.com at the Webby Awards!

Image Credits: Michael Loccisano (Opens in a new window) / Getty Images (Image has been modified)

Two businesskinda.com podcasts, Chain Reaction and Found, have each been nominated for Webby Awards in the Best Technology Podcast category.

Cast your vote before Thursday April 20!

Tech investors’ obsession with profit is already waning

Image Credits: z_wei (Opens in a new window) /Getty Images

Bessemer Venture Partners’ State of the Cloud 2023 report suggests that investors who have shifted their focus from growth to profitability are “already looking to grow again,” writes Alex Wilhelm in TC+.

“For startup founders, the rapid shift in investor preferences can feel like a whipsaw,” he writes.

“But such an evolution in market preferences is actually quite logical and, frankly, a bit boring in how it plays out.”

Janice has been with businesskinda for 5 years, writing copy for client websites, blog posts, EDMs and other mediums to engage readers and encourage action. By collaborating with clients, our SEO manager and the wider businesskinda team, Janice seeks to understand an audience before creating memorable, persuasive copy.