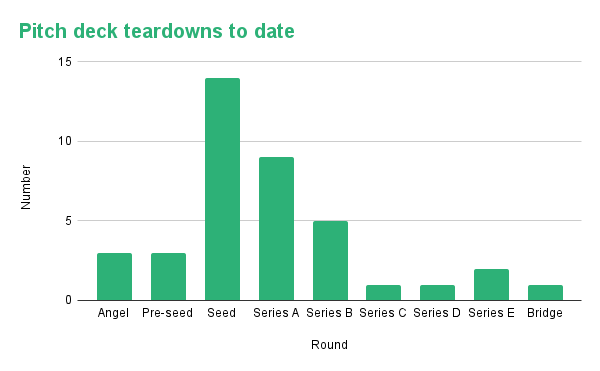

Welcome to our 40th Pitch Deck Teardown! Thank goodness time flies.

Of those 40, only three were angel rounds, so today we’re taking apart the angel deck MiO Marketplace, a platform for media publishers and buyers. The company raised $550,000 at a pre-money valuation of $3.6 million.

Breakdown of the pitch deck teardown so far. Image Credits: businesskinda.com / Haje Kamps

We’re looking for more unique pitch decks to break down, so if you’d like to submit your own pitch decks here’s how to do it.

Slides into this deck

MiO Marketplace is coming out of the gate hard and going on and on. However, the deck didn’t include all the key parts, and I wish the company had done a few things differently, but we’ll get to that. For now, here are the 16 slides that make up the angel deck:

- Cover slide

- History Slide (“Evolution of Online Marketplaces”)

- Vision and mission slide

- Problem slide

- Solution slide

- Occasion slide

- Market size slide

- Contest Slide (“B2B SaaS for Media Buyers/Sellers”)

- Value Proposition Slide 1 (“Buyer Features”)

- Value Proposition Slide 2 (“Intelligence for Sellers”)

- Business model slide (referred to as “Go-to-market”)

- Traction slide

- Financial slide (referred to as “Forecasts”)

- Team Slide (“Founder”)

- Board slides

- Contact slide

Three things to love

MiO nails its pitch in a few really important parts, which is always so delightful. The team slide focuses on the right things, it does a good job of explaining its value, and including the company’s mission helps solidify how it views the landscape.

Really promising team slide

[Slide 14] This is how you show the founder-market fit. Image Credits: MiO Marketplace

In the earliest stages of a new company, investors don’t have much to do: there isn’t much of a product yet, there isn’t much traction — there really isn’t much of anything. So, how do you evaluate an early stage business? You look at things like whether there is a big enough market, problem and opportunity for return, but most importantly you need to consider whether this is the right team to bring this product to market. On paper, CEO and founder Sean Halter is a good bet. He claims to have decades of experience and appears to have a thorough knowledge of the market. They are all useful. So what does a VC do next? A little light due diligence to see if what’s on the slide matches.

Janice has been with businesskinda for 5 years, writing copy for client websites, blog posts, EDMs and other mediums to engage readers and encourage action. By collaborating with clients, our SEO manager and the wider businesskinda team, Janice seeks to understand an audience before creating memorable, persuasive copy.